Ready To Dominate Your Taxes And Pay the Least Amount of Tax Legally Possible?

INTRODUCING

The Tax Course

Ex-IRS Agent reveals the secrets to maximize your refunds, save thousands of dollars, & audit-proof your business.

Carlotta Thompson audited many, many businesses over the 7 years she worked for the IRS. The costly mistakes and lack of information she saw inspired her to leave the IRS and start her own business helping entrepreneurs understand their taxes ad save thousands in a few simple steps!

*IMPORTANT: Earnings and Legal Disclaimers

Any tax strategies, or tax examples, are only estimates of what is possible. There is no assurance you’ll do as well. Results are based on many factors. Use caution and check with your accountant, lawyer or professional adviser, before acting on this or any information.

This advice is not intended and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS.

What is your biggest stress, headache and fear as a business owner?

Taxes? Fear of getting audited? Terror over receiving a nightmare tax bill?

You want to do everything right so they don't come knocking but honestly, no one has ever taught you what you are supposed to do!

You haven't had a tax strategist brainstorm how all of your expenses can turn into deductions, which means you are paying too much.

If no one has ever sat down and explained to you in detail exactly what documentation the IRS expects you to keep, an audit means that you are screwed!

The Secret to Saving Thousands, Tens of Thousands, Even Hundreds of Thousands in Taxes...Legally

Tax strategy may seem like something that's only for the rich and famous but I'm here to tell you that is not true.

(They don't care if you understand the strategies that will help you...even if you just started your business and aren't even making money yet!)

EXPERT TAX STRATEGY = CASH IN YOUR POCKET!

Think that you're covered with a good accountant? Well, it's shocking to realize that they are only making sure your taxes are done.

That leaves a LOT of room for error.

Here's the hard truth. As a business owner, the IRS holds you to a higher level of accountability than all other taxpayers.

They expect you to thoroughly understand the signed return.

They expect you to know proper documentation in detail.

And sadly? They don't care if you overpay as long as you don't underpay.

Worst of all, the IRS doesn't hold your accountant responsible for any of these errors...unless you can prove the accountant made a mistake.

And good luck with that, because in all of my years of examining businesses for the IRS, the accountant never took the blame.

(Even if it was their mistake, you would only get out of paying penalties. The tax is still due.)

SO HOW DO YOU DO THAT?

The Simple Rules That You Need To Know

✔️ How to keep the exact records that the IRS wants to audit-proof your business.

✔️ Create a forward thinking, money saving master tax strategy to save thousands.

✔️ Be able to hand your accountant the specific advanced tax strategy that you need.

24/7 Access. Work at your own pace.

Master your taxes.

Master your taxes.

Save thousands of dollars.

Here's How it Works:

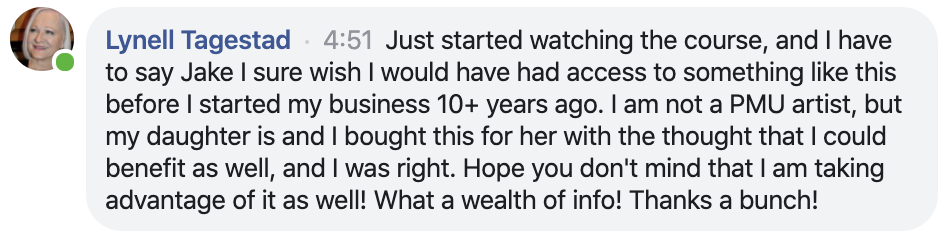

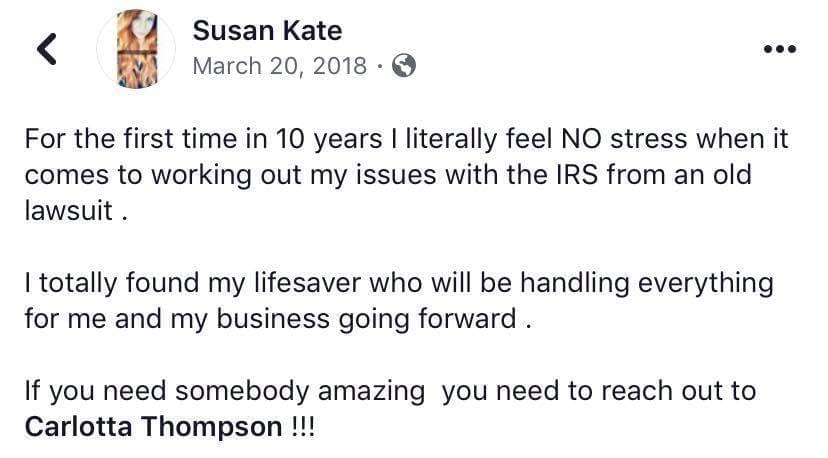

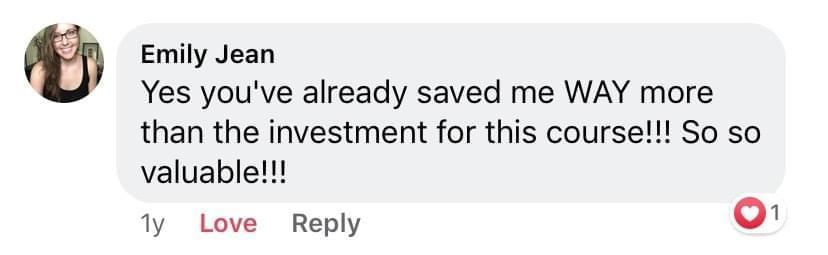

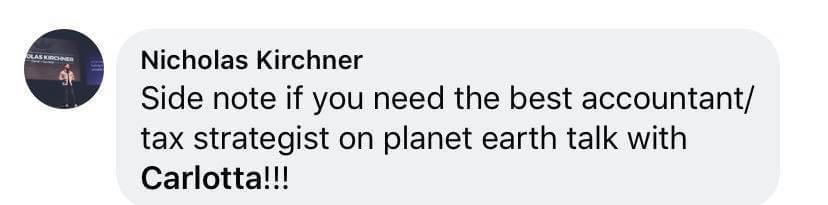

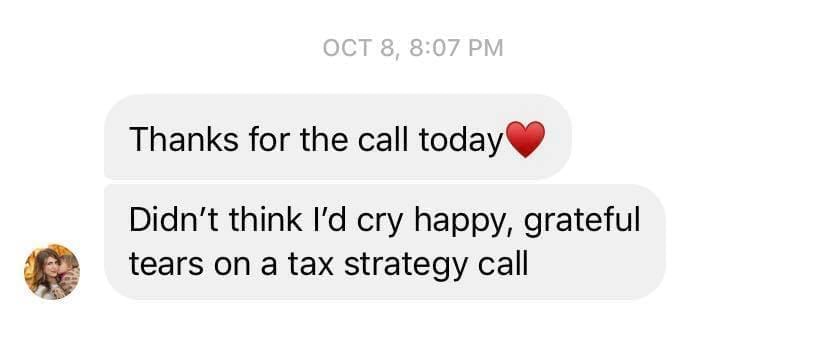

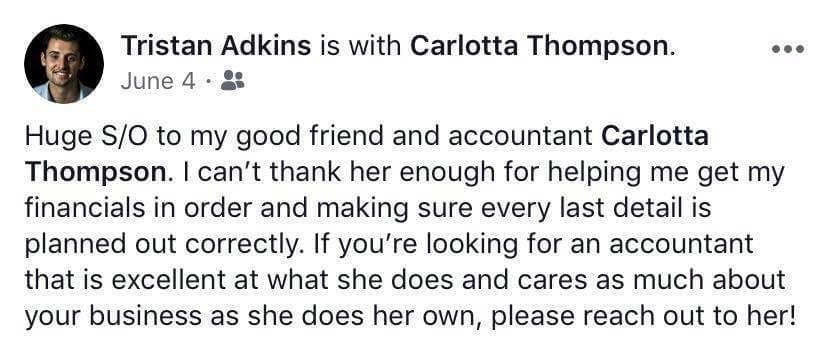

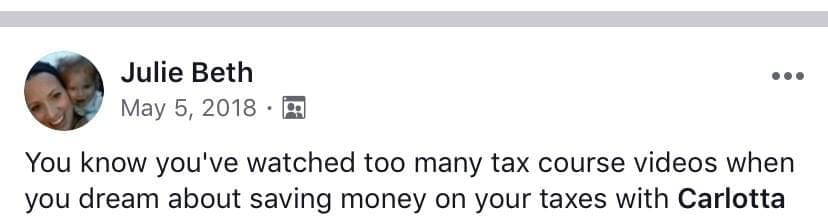

See What Others Have Said About Carlotta!

Ready to learn the simple strategies that keep you on top of everything so you never miss a deduction or a deadline?

The Tax Course

Price

$497

Email:

How do I know if I need this?

Here's the scoop. You need this course whether you an expert or a beginner with taxes.

As a former IRS agent, I've made this program 100% beginner friendly.

Pair that with the fact that I have hundreds of success stories from people making $50,000 and even $100,000 per month with this blueprint. Over 80% of those people are complete beginners.

I was blessed with a very specific talent. That talent is to take something as complicated (and sometimes scary, let's be honest!) and be able to explain it simply so that anyone can understand.

The bottom line is, if you are a complete beginner, this course is for you.

But even if you're experienced, this course is also for you. You'll cut the amount of work, overpayments & struggles over taxes by more than you can even imagine!

With a proven history of thousands upon thousands of dollars saved for our client track record to prove that. The results speak for themselves!

I can guarantee that with full confidence because I know the IRS tax system from experience and will show you exactly what works.

Secure Payment

All orders are through a very secure network. Your credit card information is never stored in any way.

We respect your privacy and protect it as though you are family.

️

️